The COVID 19 pandemic has wreaked havoc on businesses across industries. While large organizations have all the resources to adapt to emerging technologies and internet tools to tackle some of the hardships due to the pandemic, Micro, Small and Medium Enterprises (MSMEs) find it difficult to keep up. Easy access to finance and its proper management has always been a trivial task for such MSMEs, especially in India. These micro and smaller firms are typically more financially fragile and have very small cash buffers than their larger counterparts, making them less resilient to any crisis. Data from 119 developing countries shows that MSMEs perceive access to finance and its appropriate management as the most significant obstacle, which hinders their growth.

In India, MSMEs account for about 99% of all the enterprises, comprising 63 million MSMEs across various industries and diverse geographic locations. Our economy is heavily dependent on the success and growth of MSMEs. Proper Financing and its management is one of the sure-shot ways to do so.

MSMEs, particularly micro and small businesses, face a significant funding gap, as they generally have a difficult time obtaining credit from formal financial institutions. This is largely due to information asymmetry, lack of previous credit history, and formal documentation, etc, which results in the unwillingness of lenders to provide financing to them. Even if they get financing, it typically takes time in approval and requires hard collateral like movable property and other rigorous documentation.

The pandemic has forced the MSMEs to digitize and adopt the digital way of life or what has been dubbed as “the new normal”. In the online economy, digitization, digitalization and digital transformation have offered a promising potential to unlock the bottlenecks faced by MSMEs and bolster their growth. Historically, MSMEs have significantly low adoption of technology such as the usage of online channels for employee management HR software, payroll management systems, digital accounting, payment transactions through multiple online channels or even for business communication. The reason being the inability in handling the complexities of such professional software.

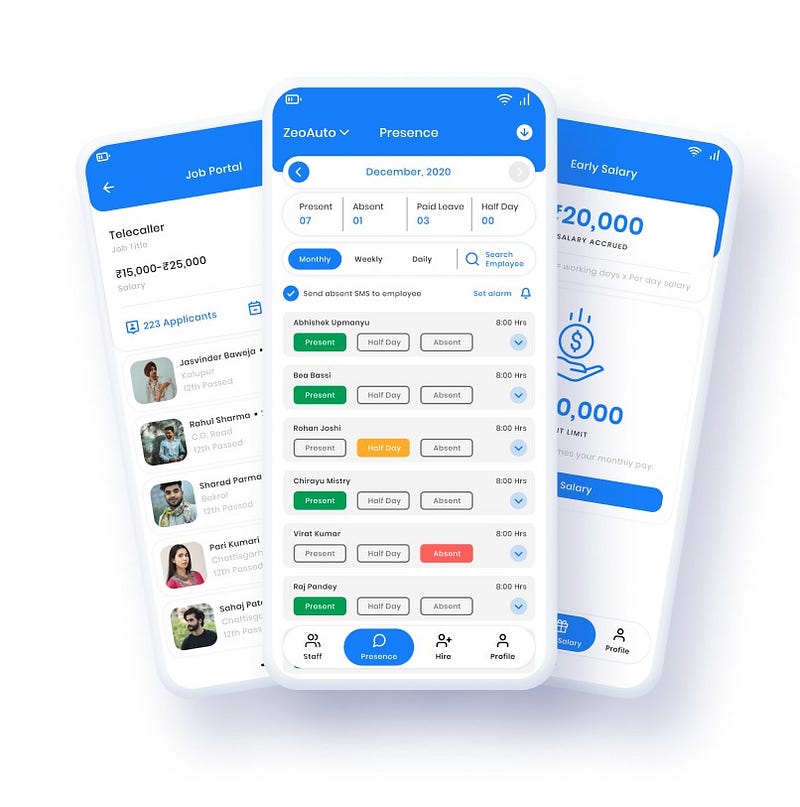

With this in mind, SalaryBook has come up with a complete digital solution that is very easy to handle and use. In fact easier than using WhatsApp, FaceBook or YouTube. SalaryBook’s mobile app provides a complete digital solution to all your employee management related issues. SalaryBook’s smart attendance management system (GPS enabled) is one of its most striking features. Daily reports in simple pdf format help the owners have full control over their enterprise. Payroll Management has also been made absolutely easy with SalaryBook.

Download SalaryBook Now:SalaryBook: Staff attendance, Pagar & work manager – Apps on Google Play

India’s Best Pagar & Khata App for staff attendance, work, Jobs & Salary Book. By using SalaryBook, you can Easily…play.google.com

For More Information, Visit:SalaryBook: Staff Attendance, Salary & Payroll Management App

Looking for a Job, Look no further! SalaryBook is the perfect Free Job Search Portal for all the Blue and Grey Collar…salarybook.co.in